Tax Inequality in the United States

From everyone who has been given much, much will be demanded; and from the one who has been entrusted with much, much more will be asked.

Luke 12:48

It's well established that there is great income and wealth inequality in the United States and that God is not pleased about it. No one can doubt either of those things.

The more difficult and controversial issue is what to do about it. Specifically, whether our tax laws contribute to the problem. Are the rich fairly taxed? Conservatives say the rich pay a high share of taxes in the U.S.; liberals say the rich pay a low tax rate. Both sides shout at each other and it's easy to get lost in the smoke.

The truth is that both liberals and conservatives are right in what they say, as far as they go. The rich do pay a relatively high share of total taxes in the United States; yet they also pay a relatively low share of their income in taxes (they have a relatively low individual tax rate).

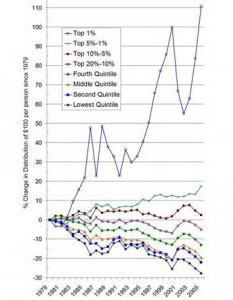

The key to understanding how both things are true is to understand the incredible increase in income and wealth the rich (top 1%) have gained since the "Reagan Revolution" in 1980.

Incredibly, in America today, the bottom 80% of us share only 7% of the wealth.

According to the nonpartisan Congressional Budget Office (CBO), from 1979 - 2007 the share of national income received by the top 1% more than doubled, from 9.3% to 19%. That's a 104.3% increase.

Yet, the share of total federal taxes paid by the top 1% only rose from 15% to 28%. That's an increase of 86.6%.

If the tax burden in the U.S. had remained the same from 1979 until today, given the surge in income to the top 1% since 1979, they would have seen their share of taxes increase by 17.7% more than it has increased. This is also reflected in the drop in average total federal tax rate of the super- wealthy from 37% to 29.5%. [All of these numbers come from a CBO report and include all federal taxes, not just income tax.]

To illustrate the fallacy of the conservative complaint that the rich allegedly shoulder too much of the income tax burden -- let's push things a bit further. Let's assume the top 1% received all income in the United States. And, let's assume they paid 95% of the income taxes. Would that be unjust toward the rich? Of course not. It would be unjust toward the 99% who earn nothing and pay 5% of the taxes. Yet, that's exactly what's happening in the United States today. Not to that degree, yet, but the point holds. Both tax rates and share of taxes paid relative to income have dropped for the wealthy. It seems fair to conclude, as a matter of fact, that the rich in America no longer pay their fair share.

The truth is that tax policy in the US has actually been regressive since 1979 as the share of taxes paid by the wealthy has declined relative to its share of income. Meanwhile, the reverse has happened for the rest of us; our share of the tax burden has increased relative to our share of income. This is particularly true for the bottom 80% of us.

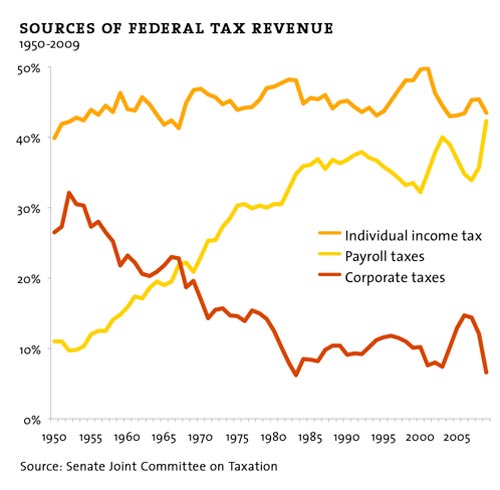

Take a look at the next chart. Notice which taxes have been going up and which have been declining. That's right, corporations (mostly owned by the wealthy) have been paying less and less while workers (mostly the poor and middle class) have been paying more and more in payroll taxes.

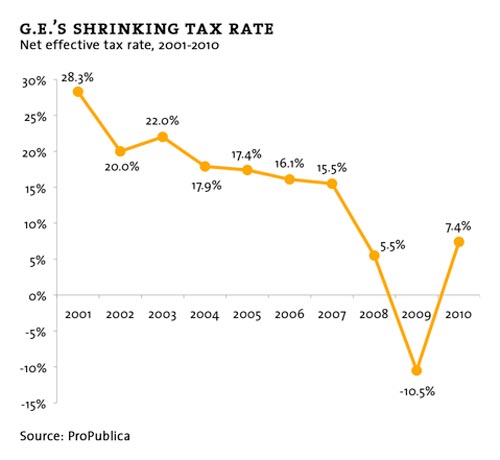

Here's what GE paid between 2001 - 2010 -- despite billions in profits.

Republicans, like Paul Ryan, have truthfully stated that income taxes have, in fact, become just a tiny bit more progressive since 1979.

However, this is a distortion of the truth that overall tax rates have become more regressive. As stated by Timothy Noah:

Ryan says that federal income taxes are more progressive than they used to be, but he doesn't say that all federal taxes are more progressive than they used to be. He doesn't because he can't. When you combine all federal taxes, including the payroll tax (which started out regressive and has become more so), the capital gains tax, the corporate tax, etc., etc., then the federal tax system has become more regressive ... just like you thought it had. And that's before you also factor in the effects of state and local taxes, which also tend to be regressive.

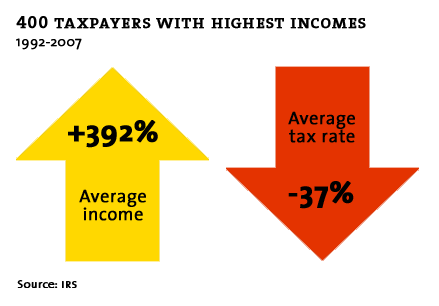

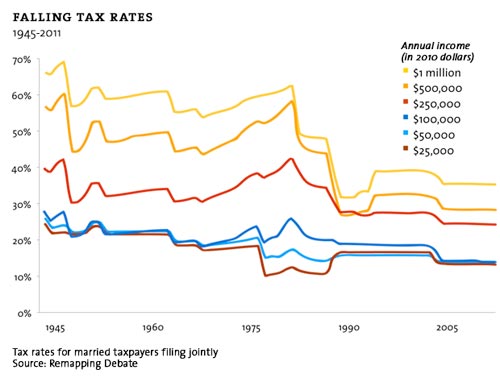

Here's a chart that shows how, despite huge income gains, the big change in taxes over the past 50 years has been the decline in the tax rate paid by the wealthy.

Is this the definition of injustice?

Check out the 90% tax rate the rich paid back in the "good old 50's."

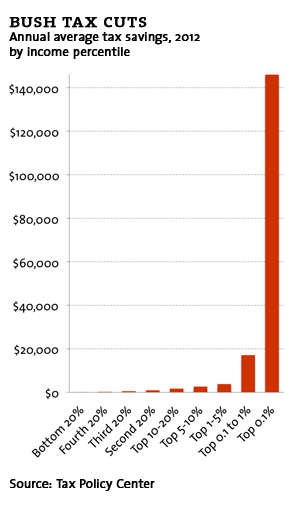

There's lots of debate about whether to extend the Bush tax cuts for the wealthy. Republicans say those cuts were fair since everyone got a cut. Sure, but, look at who got the biggest cut. If you've gotten this far in this article, then you won't be surprised. Maybe horrified though?

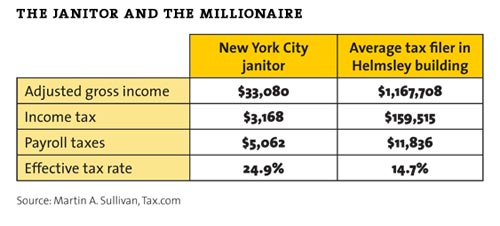

Conservatives often highlight the large percentage of people who pay no federal income tax (about 45%). However, they leave out the fact that all workers pay Social Security and Medicare taxes and these taxes, in total, now collect nearly as much as the federal income tax. I note that most of the top 1% pay no Social Security or Medicare taxes because their income is considered "unearned" income and thus not subject to those taxes.

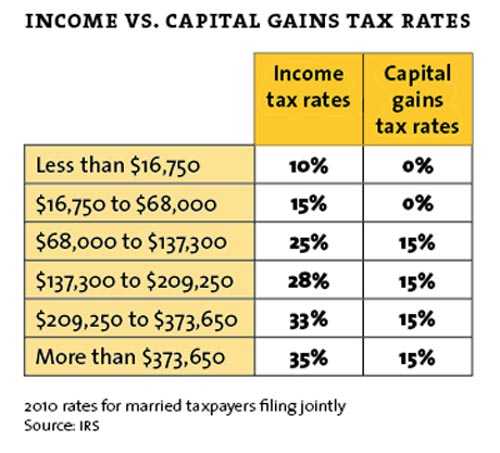

For instance, Mitt Romney's 2010 tax return shows that he had no income from wages, salaries or tips (see line 7) -- yet made over 21 million dollars in dividends and capital gains which was taxed at a "preferential" rate. In the end, Romney paid only a little less than 14% federal income tax rate and paid nothing into Social Security, Medicare, or Medicaid. Note that 14% rate doesn't even take into account huge untaxed gains in Romney family IRA's which have made millions, apparently (though he won't say) from venture capital investments by his former firm, Bain Capital. Note also, that many wealthy people pay even less than Romney did. Romney also has refused to release any returns from years before 2010.

The secret to Mitt Romney's low tax rate (in addition to various tax deductions "loopholes") can be seen in the chart below where we see that "unearned income" like capital gains is given preferential treatment over "earned income" like wages.

On Fox News and Rush Limbaugh's program you often hear breathless reports about the high tax burden Americans, and especially American corporations, supposedly bear. This just isn't true. The truth is that federal taxes in America are lower now than they've been in over 60 years. Recently, they've been running at about 14% of GDP, well below the historical 18% average.

Taxes, both individual and corporate, are lower in the United States than in virtually any other industrialized country. Statistics you hear to the contrary are usually based on nominal tax rates, not effective rates actually paid after deductions are taken. If you find this information surprising and have any doubts, don't take my word for it, just ask the conservative economist Bruce Bartlett who was an economic advisor to Ronald Reagan and George Bush.

This chart shows the declining tax rates between 1945 and 2011. Notice whose rates have fallen most!

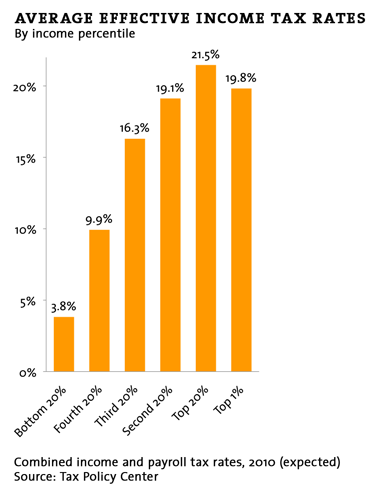

You can see here that the top 1%, despite enormous income gains, now pay a lower overall tax rate than many in the middle class. Keep in mind, as we've seen with Mitt Romney, not everyone in the top 1% pays even as much as this chart suggests.

[Here's an article that further substantiates that the very rich (like Mitt Romney) pay a lower tax rate than many in the middle class. Here's info about the cost of the Reagan - Bush tax cuts.]

Many of you say, "now wait a minute, I'm having a harder time than ever paying my taxes." That's certainly true for most of us. The reason is that the income of most Americans, after factoring in inflation, has declined over the past 30 years. However, our share of taxes has not declined at all or, if it has, then it hasn't declined as much as our income has.

This discussion of tax fairness is important because even slight shifts in tax rates for the wealthy results in trillions of dollars over time. So, this goes to the heart of our fiscal problems. Yet, the failure of the rich to pay their fair share is rarely mentioned as a reason for our deficits. Had the wealthy continued to pay the share of taxes (percent of income) that they paid in 1979, most of our deficit and debt would never have happened. And, that means hundreds of billions in interest paid on that extra debt would never happened either. That money could instead have been used to fund our schools, roads, alternative energy sources, health care, law enforcement, etc.

In effect we have been borrowing money from China to make up for the extra money the rich have deposited in their bank accounts - for decades now. The result is the deep fiscal hole we now must, somehow, dig out of.

The truth, that you won't often hear, is that the reason for our budget deficits; the reason we can't afford to pay our school teachers or build our roads, is not due to overspending. Rather, it's due to lack of funding caused by tax cuts for the wealthy. [I note that we do need to do something soon about out of control health care costs.]

The next time a conservative politician says we just have to cut more programs to balance the budget, ask them why the wealthiest country in the world can't afford to pay it's teachers or pave its roads. Ask them why the rich are paying the lowest level of taxes since 1929.

Update: The Republican House of Representatives passed the budget proposed by Paul Ryan. The Ryan budget would cut $5.3 trillion in government safety net spending for the poor and redistribute $4.3 million to the rich through tax cuts to stave off an "insidious moral tipping point."

Wow, Republicans aren't even subtle any more about their favoritism of the wealthy. We have the greatest income inequality since 1929. The rich have never had it better; the poor and shrinking middle class haven't had it this bad since the Great Depression. So, what's the Republican answer? Why take more from the poor and give it to the rich. Of course, seems logical. Read more about Paul Ryan, Ayn Rand and the gospel.

Are you kidding me? Is this why some think we need the Buffett Tax Rule and that Democratic public policy better represents gospel values than Republican public policy?

Tax Inequality Articles:

- Flat Tax Proposal

- Rich Pay Their Fair Share

- What is the Full Cost of the Reagan-Bush Tax Cuts?

- GOP Doubles Down on SNAP Cuts

- Tax Dollars Going to Help the Poor

- CRS Tax Study Undermines GOP Tax Policies

- Christians Should Care About Fair Taxation

- Buffett Rule

- Top Tax Rate Historical

- Mitt Romney Tax Return

Custom Search

Custom Search